As Anniversary of Sandy Hook Shooting Approaches, Cerberus Capital Management Makes Tepid Offer Allowing Investors to Unload Toxic Firearm Investments

NEW YORK, NY — A late-Sunday news report has indicated the Cerberus Capital Management LP will allow individual investors the option of divesting from Cerberus’ stake in Freedom Group, the manufacturer of the military-style assault rifle used in the Sandy Hook shooting. Cerberus Capital Management owns a 94% stake in Freedom Group and has had difficulty structuring a deal to […]

Newtown Families Demand Cerberus Capital Management End Investment in Freedom Group Gun Manufacturer

NEW YORK, NY — Families of Sandy Hook victims, U.S. Rep. Charles Rangel (D-NY-13), Geoffrey Eaton, NAACP Mid-Manhattan President, and a diverse coalition of gun violence prevention advocates held a press conference and action at 12pm today, outside the offices of Cerberus Capital Management (875 3rd Avenue, New York) to call on the hedge fund to immediately sell all […]

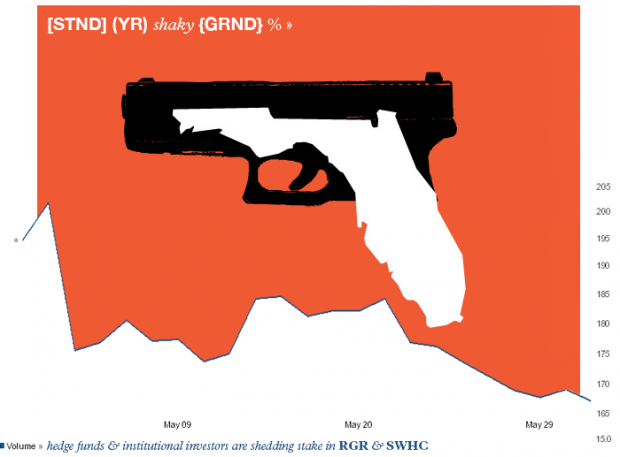

Standing on Shaky Ground: Activists Pressure Hedge Funds to Purge Gun Stocks

New York, NY — On March 18th, 2013 The Sparrow Project published a detailed and scathing report naming and shaming two hedge funds, Owl Creek Asset Management and Impala Asset Management, for purchasing large volumes of gun stocks immediately following the December 14, 2012 massacre at Sandy Hook Elementary School. Murmurations on Wall Street and Owl […]

Meet the Hedge Fund Managers Turning a Profit on the Sandy Hook Massacre

New York, NY — It has been argued that capitalism, if given the opportunity, would devour its own legs and collapse upon itself. Putting all hyperbole aside, what would you do if you learned that a US company was actively monitoring national tragedies like the shooting at Sandy Hook Elementary School, only to develop reflexive investment […]