New York, NY — It has been argued that capitalism, if given the opportunity, would devour its own legs and collapse upon itself. Putting all hyperbole aside, what would you do if you learned that a US company was actively monitoring national tragedies like the shooting at Sandy Hook Elementary School, only to develop reflexive investment strategies designed directly to capitalize off the pain, suffering and hysteria, in the wake of those events? Would you be in disbelief of such wanton disregard for life? Would you chalk it up to business as usual, for Wall Street’s most parasitic actors? Or, would you take action to stop it?

Enter, Stage Left — Two of the Worst People in the World…

While some of the nation’s largest hedge funds and money managers have paused in the wake of Sandy Hook to review their portfolios for exposure to gun stocks, and in some cases begin the process of selling off their gun assets, two hedge funds have done just the opposite. Jeffrey Altman, Founder and Portfolio Manager for Owl Creek Asset Management, and Robert Bishop, of Impala Asset Management, each seized an opportunity in the days following the Sandy Hook Shooting, to purchase millions of shares in gun stocks (1,616,300 shares [valued at $13,642,000] and 893,938 shares [valued at $27,787,000], respectively). Notice of Altman’s and Bishop’s purchases only became available when they disclosed their fund’s 4th Quarter 2012 holdings to the SEC, in February [HERE, and HERE]. Altman’s and Bishop’s intentions, as deduced by peers in asset management, are to turn the fears and murmurations of new gun regulations into profits, as a newly fabricated demand for firearms like the Bushmaster .223 Caliber Assault Rifle, the AR-15 and the Ruger Mini-14—each potentially at risk of regulations—outpaces their supply on shelves at retailers.

Jeffrey Altman: Chronically Single, Economically Depraved…

Depicted by his Bridgehampton neighbors as a man who is “chronically single” and meticulously decorates the walls of his 7.9 million-dollar Ambleside Lane home with “series of Warhol-esque prints of semi-nude women,” Jeffrey Altman is not just the ‘Fox of Finance’ flirtatiously depicted in his 2010 New York Magazine profile, he is also a deeply cynical person known for making morally bankrupt decisions for profit. Altman began his career in 1985 as an assistant to Michael Price at Heine Securities. It was at Heine that Jeffery made a name for himself by profiting off of distressed assets. In 2001, just as he was about to make the transition to managing his own fund (Owl Creek), Jeffrey commented in a Forbes Magazine roundup titled ‘Let us Prey’ wherein he gave advice to fellow “vulture” capitalists…

Depicted by his Bridgehampton neighbors as a man who is “chronically single” and meticulously decorates the walls of his 7.9 million-dollar Ambleside Lane home with “series of Warhol-esque prints of semi-nude women,” Jeffrey Altman is not just the ‘Fox of Finance’ flirtatiously depicted in his 2010 New York Magazine profile, he is also a deeply cynical person known for making morally bankrupt decisions for profit. Altman began his career in 1985 as an assistant to Michael Price at Heine Securities. It was at Heine that Jeffery made a name for himself by profiting off of distressed assets. In 2001, just as he was about to make the transition to managing his own fund (Owl Creek), Jeffrey commented in a Forbes Magazine roundup titled ‘Let us Prey’ wherein he gave advice to fellow “vulture” capitalists…

“Even the smaller-time vultures, with $50 million to $100 million under management, have to focus on a smaller number of opportunities” — Jeffrey Altman

The fact that Altman uses the term “vulture” when referring to his peers should be telling in itself, but it is how he sees “opportunities” that is the most noxious. When most of the nation was drowning in grief in the days that followed the Sandy Hook shooting, Altman saw an “opportunity” to profit off the murder of the 6 Sandy Hook faculty and 20 elementary school children.

On Friday December 14th, 2012, at approximately 9:32am, just two minutes after the opening bell at the New York Stock Exchange, Adam Lanza exited his black Honda Accord outside of Sandy Hook Elementary School. Before entering he shoots out the school’s glass double-door entrance. As Lanza begins shooting children inside, 77 miles away on Wall Street, brokers are buying and selling shares of the Smith and Wesson Holding Company (SWHC) for $9.54 a share. By days end 28 people would die, including Lanza and his mother, and shares of SWHC would see a decrease to $9.13 per-share.

It would not be until after the weekend that SWHC would take their biggest hit.

During the weekend of December 15th, 2012 every media outlet was saturated with coverage of the massacre. By Monday morning many investors will express a crisis of conscience in owning shares of SWHC, the manufacturer of the AR-15 Assault Rifle (Lanza’s Bushmaster Rifle was modeled after the AR-15). By Tuesday, December 18th, 2012, SWHC would fall to a 6-month low of $7.79 per-share. This is where Jeffery Altman seizes his “opportunity.”

Altman’s process is to purchase equity in a distressed company if he feels its listing is undervalued or if he feels he can advocate for the companies listing to reach a higher value. Applying this process, Altman, on-or-around Tuesday December 18th, paid approximately $12,590,977 to acquire 1,616,300 shares of SWHC, the supposition being that it was only a matter of time until the national debate over gun control—reinvigorated by the tragedy at Sandy Hook— would trigger an avalanche of gun sales, specifically at-risk guns like SWHC’s AR-15. In practice, Altman’s morally bankrupt process has already turned a profit. Should Altman decide to sell his stake today, he could receive approximately $14,886,123, which would pay out an approximate profit of $2,295,146. The fact that Altman has not already sold his shares should indicate that he believes that SWHC will continue to appreciate in value, regardless of any investors jumping ship after Sandy Hook.

The Wolf in the ‘Riding Hood’ Stories…

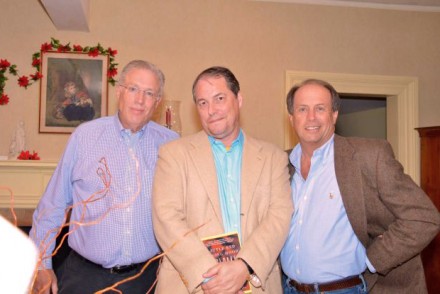

On the evening of December 14th, 2012, while Sandy Hook Elementary School is cordoned off with yellow tape, 30 miles away in New Canaan, Connecticut, an exhibit at the town’s historical society, titled “Seeing Red” celebrates a piece of predatory folklore. The exhibit provides a historical overview of the many versions of the “Little Red Riding Hood” story, with gleeful emphasis on the older, lesser-told versions of the story wherein Little Red and her grandmother suffer a far more gruesome fate, each being ravaged by the wolf. The primary sponsor of the exhibit is Robert Bishop, a New Canaan resident and portfolio manager of Impala Asset Management (pictured holding an anthology of ‘Little Red Riding Hood’ below).

Robert Bishop belongs to the same predatory class of investors as Jeffrey Altman. Like Altman, on-or-around Tuesday, December 18th, 2012 Bishop pounced on an opportunity to purchase 346,252 shares of the Smith & Wesson Holding Company (SWHC) and 547,686 shares in Sturm Ruger & Co (RGR) [valued at $2,922,000 and $24,865,000, respectively]. Sturm Ruger, manufacturer of the Mini-14 semi-automatic rifle used by Anders Breivik in the 2011 youth camp massacre on Norway’s Utøya Island that killed 69 people and injured 110, also hit a 6-month low price of $40.60 per-share on December 18th, 2012 and has seen a steady increase in value thereafter. In the wake of the Norway massacre and the theatre shooting in Aurora Colorado the AR-15 and Ruger Mini-14 have been stigmatized as weapons of choice for deranged mass murderers. The fact that anyone—let alone someone who lives a short distance from Sandy Hook Elementary School—would seek to purchase positions in these manufacturers and hedge their bets on a future inflated value, means that they have to be able to either turn a blind eye to the horrific realities tied to those stocks, or that they are literally Wall Street’s own manifestations of the predatory monsters depicted in fairy tales. Any psychologist would have a field day attempting to analyze why a predatory investor like Bishop has such an affinity for a tale of a wolf brutalizing a young girl.

“Activist” Investing?

The term “activist investing” is used in Bishop’s and Altman’s “vulture” community, largely when referring to instances when a hedge fund like Owl Creek purchases a large portion of a company’s equity in an attempt to manipulate the boardroom workings of that company (install a board member, replace management, etc) but there is also a less talked about, media-related, element to hedge fund advocacy. In order to navigate tricky insider trading laws, hedge funds use a “heard it from a friend” style when scooping stock picks to the financial blogosphere. While Altman seldom responds to media requests, he does not think twice about scooping financial bloggers about a company he wants to send droves of investors to. In the example of SWHC, the scoop was picked up by Brian Nelson’s online financial analysis service, Valuentum, who on March 6, 2013, published a syndicated online report on SWHC’s momentum titled ‘Smith & Wesson Rides the Gun Boom’ the following is an except from Valuentum’s report…

“Gun manufacturer Smith & Wesson (SWHC) announced fantastic third quarter results, as demand outpaced supply. Revenue increased 39% year-over-year to $136 million, handily exceeding expectations. Earnings, adjusted to reflect continuing operations, more than tripled year-over-year to $0.26 per share, exceeding consensus estimates.

We’re not surprised by the results, as other firms like Cabela’s (CAB) and Big 5 (BGFV) reported that gun sales have surged in the wake of the Sandy Hook tragedy and fears of new gun regulations. The trend looks durable at this point, and with the general lack of compromise in Congress, we think it could take awhile for any new national gun legislation to surface.”

Republicans Secretly Cheering for Gun Control?

We should be careful not to conflate Altman’s and Bishop’s intentions with the heated and largely partisan debate surrounding our nation’s abusive relationship with the gun industry. A review of the FEC’s records of 2012 political contributions shows that most of the principals of the 20 hedge funds that hold significant gun investments also contribute large sums of money to Republican candidates, but the fact that they identify as Republican does not, in all cases, spell blind allegiance to the gun industry.

Cerberus Capital Management, owner of the single largest portfolio of gun company assets and whose predominantly Republican board includes former Vice President Dan Quayle, made a statement to the press, four days after the Sandy Hook shooting, that they would begin the process of selling their 94% stake in “The Freedom Group,” a gun manufacturer portfolio valued at ~$700-957 million, which includes nearly the entire private equity of Bushmaster Arms (manufacturer of the .223 caliber assault rifle used by Sandy Hook shooter, Adam Lanza). Similarly, Tiger Global Management, CEO Chase Coleman, named the “hottest money manager on the planet” by Forbes Magazine, and a significant contributor to the GOP, showed no hesitance in quickly (albeit quietly) selling all of his 800,000 shares in Sturm, Ruger following Sandy Hook.

Similarly, both Jeffrey Altman and Robert Bishop donated significant amounts of money to Republican candidates in 2012, but unlike Cerberus Capital and Tiger Global, Altman and Bishop are both buying in when the largest players are bowing out, and a key ingredient in their profit making formula IS gun control (or at least a perceived threat in the marketplace of future gun regulations). Both Altman and Bishop need the looming specter of gun control to provide the momentum needed to watch their positions in SWHC and RGR steadily climb. Even more telling is the indication in Valuentum’s report that due to the dysfunction of congress, any regulations may take some time to manifest, and until then the price will steadily climb, unless someone steps in to do something about it…

Holding the Monsters Accountable…

As you read this Jeffrey Altman and Robert Bishop will have already made millions of dollars in profits from Sandy Hook. They are only able to do this because they are accustomed to having no one hold them accountable for their economic depravity. Utah Phillips, a celebrated singer-songwriter and environmental advocate once said, “the earth is not dying, it’s being killed, and those who are killing it have names and addresses.” Indeed Phillip’s words seem all too appropriate when applied to the case of these two hedge fund managers who have decided to turn a profit off of Sandy Hook. Altman and Bishop are proof positive that monsters are real …and they summer in the Hamptons.

These men should be viewed as no less a threat to our communities than sex offenders, and should be ostracized by their colleagues and neighbors no differently than sex offenders.

Compiled below is a list of contact information for Owl Creek, Impala, Jeffrey Altman and Robert Bishop, as well as ways you can contact their colleagues to politely inform them about Altman’s and Bishop’s efforts to turn Sandy Hook into a profit.

We demand nothing short of a complete sale of their positions in SWHC & RGR with any profits made from their sales donated to the families of Sandy Hook victims.

OWL CREEK ASSET MANAGEMENT»

(please make polite phone calls, and do not say anything that can be misconstrued as threatening, no matter how angry you are, also, please only call each number once)

Owl Creek Asset Management

640 Fifth Avenue, 20th Floor

New York, NY 10019

Phone: 212-688-2550

(please phone them and ask them to sell their position in the Smith & Wesson Holding Company [SWHC])

Jeffery Altman

Portfolio Manager, Owl Creek

205 East 22nd Street, 2M

New York, NY 10010-4622

(please consider making a polite phone call to Jeffrey’s neighbors at The Gramercy Park Habitat to let them know that he is turning Sandy Hook into a profit. For a complete listing of tenants in his building click HERE)

Jeffrey Altman

Portfolio Manager, Owl Creek

19 Ambleside Lane

Bridgehampton, NY 11932

(please consider making a polite phone call to Jeffrey’s neighbors on Ambleside Lane to let them know that he is turning Sandy Hook into a profit. For a complete list of his neighbors click HERE)

Daniel Sapadin

Chief Operations Officer, Owl Creek

400 E 89th St, #15K

New York, NY 10128

Home Phone: 212-987-2825

Use LinkedIn?

If so, you can send Jeffrey Altman an InMail HERE, Also consider sending InMail to all of the other employees of Owl Creek HERE to let them know that their boss, Jeffrey Altman, is turning a profit on the Sandy Hook massacre.

IMPALA ASSET MANAGEMENT»

(please make polite phone calls, and do not say anything that can be misconstrued as threatening, no matter how angry you are, also, please only call each number once)

Impala Asset Management

Headquarters

134 Main Street,

New Canaan, CT 06840

Phone: 203-972-4100

Fax: 203-972-4101

(please phone them and ask them to sell their positions in the Smith & Wesson Holding Company [SWHC] and Sturm Ruger [RGR])

Impala Asset Management

Manhattan Office

100 Park Avenue

New York, NY 10017

Phone: 212-625-1000

(please phone them and ask them to sell their positions in the Smith & Wesson Holding Company [SWHC] and Sturm Ruger [RGR])

Robert Bishop

Managing Principal, Impala

628 West Road

New Canaan, CT 06840

Home Phone: 203-966-1129

(please phone Robert and ask him to sell his positions in the Smith & Wesson Holding Company [SWHC] and Sturm Ruger [RGR])

The New Canaan Historical Society

nchistory.org

email: newcanaan.historical(at)gmail.com

Phone: 203-966-1776

(Please send a polite note letting them know that their sponsor, Robert Bishop has attempted to turn Sandy Hook into a profit, and ask that they talk some sense into him.)